Streaming continues to become a more potent force on The Walt Disney Co.’s balance sheet, as the company’s fiscal Q4 earnings report demonstrates.

Disney released its latest quarterly earnings early Thursday morning, reporting revenues of $22.5 billion, essentially flat from last year, and segment operating income of $3.5 billion, down 5 percent from a year ago.

While Disney is still feeling the pinch of linear TV’s troubles, its streaming business continues to grow. Most notable, the company beat Wall Street estimates with Disney+ subscribers rising by 3.8 million compared to Q3 to 132 million, and Disney+ and Hulu subscribers rising by 12.4 million to 196 million.

Direct-to-consumer revenue rose by 8 percent in the quarter to $6.2 billion, with operating income rising by 39 percent to $352 million.

Those subscriber numbers are still somewhat surprising given that Disney had two events in the quarter (which ended Sept. 25) that could impact subscribers: the short-lived suspension of Jimmy Kimmel, and the announcement of price increases. It is worth noting that the timing of subscription renewals may mean that any canceled subscriptions might not appear until the company’s fiscal Q1, and conveniently for Disney, it has previously said that it will stop reporting streaming subscribers in its next quarterly earnings report.

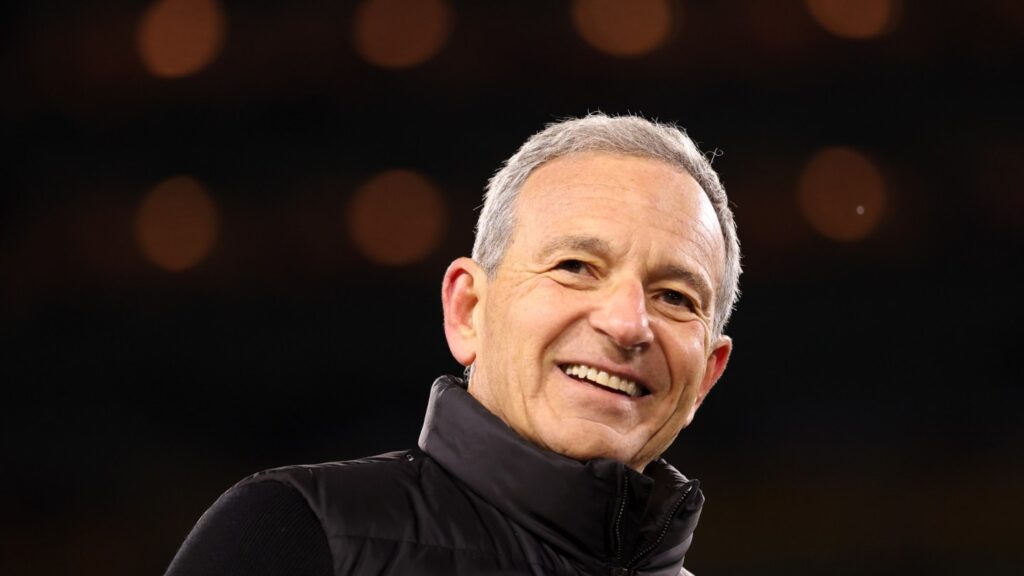

On the company’s earnings call, Disney CEO Bob Iger teased some of the possibilities coming to Disney+ in the future, including “game-like” features, and perhaps Sora-esque AI-generated UGC content.

“The other thing that we’re really excited about, that AI is going to give us the ability to do, is to provide users of Disney+ with a much more engaged experience, including the ability for them to create user-generated content and to consume user generated content — mostly short-form — from others,” Iger said

Disney’s experiences business also continued to chug along, with revenue of $8.8 billion (up 6 percent) and operating income of $1.9 billion (up 13 percent).

Sports, which is anchored by ESPN, saw its revenue rise by 2 percent to $4 billion, and operating income fall by 2 percent to $911 million, as cord-cutting continues to wreak havoc. Iger touted the launch of the ESPN streaming service on the call, though he did not give any subscriber updates beyond telling analysts that they were pleased with what they had seen so far.

“I think it’s a very positive step for the future of ESPN, because while nothing necessarily provides future proof concepts or circumstances for a business that is constantly changing, this certainly is a step in the direction of solidifying ESPN future going forward,” he said.

Cord-cutting also impacted the company’s linear TV business, which saw revenue declines of 16 percent to $2.1 billion, and operating income fall by 21 percent to $391 million. Overall the entertainment division (inclusive of linear and streaming, as well as studios) had revenue of $10.2 billion, down 6 percent, and operating income of $691 million, down 35 percent.

The company also released guidance for fiscal 2026, and some early guidance for fiscal 2027. In fiscal 2026, the company expects double-digit segment percentage operating income growth in its entertainment business, with an operating margin of 10 percent for its entertainment direct-to-consumer businesses. Sports will see low single-digit segment operating income growth, with experiences seeing high single-digit growth. The company expects double-digit EPS growth in fiscal 2027, compared to 2026.

One thing that is not in the company’s plans for 2026 is any M&A (sorry David Zaslav!). On the call, Disney CFO Hugh Johnston dismissed the potential of the company pursuing a deal for Warner Bros. Discovery (or any other major deal for that matter).

“Obviously, we don’t comment on M&A specifically, that said, with what’s happening in the industry right now, Bob and the team really built the IP portfolio that we have over the last decade, whether it was the Fox acquisition or Lucasfilm or Pixar,” Johnston said. “So we actually feel like we’ve got a great portfolio, and we don’t need to do anything from that perspective. I think we’ll let this play out in terms of other competitors. We’ll see how the various moves play out, but we like the hand that we have right now, so I wouldn’t expect us to participate in making any significant moves.”

And Disney also announced a substantial increase in its annual divided to $1.50 per share, up from $1 currently, and a doubling of its share repurchases to $7 billion.

On the film front, Iger touted the success of the company at the box office this year, highlighting the company’s dominance of the space.

“Over the past two years, our studios have delivered four global franchise hits that have earned more than $1 billion each, while no other Hollywood studio has achieved a single one during the same period,” Iger said. “Additionally, with a strong opening of Predator Badlands, the biggest opening in the franchise’s nearly 40 year history, the Walt Disney Studios has now crossed the $4 billion mark at the global box office for the fourth consecutive year.”

Disney also continues to be in a carriage dispute with YouTube TV, a dispute now passing the two week mark, the longest in the company’s history.

“We’re in the middle of negotiations right now,” Johnston said Thursday. “Things are live, they’re happening … and we’re ready to go as long as they want to.”

“It’s also imperative that we make sure that we agree to a deal that reflects the value that we deliver, which both YouTube, by the way, and Alphabet, have told us is greater than the value of any other provider,” Iger added.