Reserve Bank keeps cash rate on hold

The RBA board has left the cash rate on hold at 3.6% in December.

RBA will tighten policy as soon as February: Capital Economics

Initial notes are filtering through and this one from Capital Economics has just hit the inbox.

“The RBA sounded concerned about upside risks to inflation when it left its policy rate unchanged today and we now believe that its next move will be rate hike,” they wrote in a note.

They describe the RBA’s statement as “rather hawkish”.

“While the Bank noted that some of the recent pick-up in underlying inflation was due to temporary factors, it argued that the ‘data do suggest some signs of a more broadly based pick-up in inflation, part of which may be persistent and will bear close monitoring’,” Capital Economics wrote.

“It’s possible that the RBA will just sit out the current strength in underlying inflation.

“However, this is a risky strategy…

“The [Central] Bank noted that it will take its time to assess the strength of underlying inflationary pressures and highlighted that it still expects a further easing of the labour market.

“Given the renewed pick-up in economic activity, that’s unlikely to materialise though and we expect the Bank to hike its policy rate again as soon as February.”

‘Effects of earlier interest rate reductions are yet to flow through fully’

If there’s one thing that would be worrying the Reserve Bank, it’s that the recent pick-up in economic growth and inflation has taken place despite the lagged effect of interest rates, which often taken between 12-18 months to have their full effect on the economy.

“Financial conditions have eased since the beginning of the year, credit is readily available to both households and businesses and the effects of earlier interest rate reductions are yet to flow through fully to demand, prices and wages,” the RBA’s board notes in its post-meeting statement.

That would suggest the need to get ahead of the curve and raise rates sooner rather than later, if inflation is indeed again becoming problematic.

“On the other hand, money market interest rates and government bond yields have risen more recently,” the RBA adds.

That is the bank’s way of saying that financial markets are already doing some of its work for it, as market rates rise, especially longer-term interest rates.

How has the RBA’s cash rate tracked?

Here’s how the RBA’s cash rate has been tracking — today’s ‘on hold’ decision leaves it steady at 3.6% heading into 2026, the third straight meeting of no change from the central bank.

RBA board says ‘appropriate to remain cautious’ on rates

The Reserve Bank’s monetary policy board has played about as much of a straight bat as it can on the outlook for interest rates.

“The recent data suggest the risks to inflation have tilted to the upside, but it will take a little longer to assess the persistence of inflationary pressures,” the post-meeting statement notes.

“Private demand is recovering. Labour market conditions still appear a little tight but further modest easing is expected.

“The board therefore judged that it was appropriate to remain cautious, updating its view of the outlook as the data evolve.

“The board will be attentive to the data and the evolving assessment of the outlook and risks to guide its decisions.”

In plain English — there’s a chance inflation is getting a bit out of hand, but we’ll want to wait until at least the December quarter inflation data comes out in late January to be more certain.

In other words, a rate hike in February is a possibility, but it doesn’t feel like the RBA board is itching to press the trigger.

It all depends on the economic data between now and then.

Inflation has picked up more recently: RBA

The RBA’s post-meeting statement begins where you’d expect — inflation:

“While inflation has fallen substantially since its peak in 2022, it has picked up more recently.

“The Board’s judgement is that some of the recent increase in underlying inflation was due to temporary factors and there is uncertainty about how much signal to take from the monthly CPI data given it is a new data series.

“Nevertheless, the data do suggest some signs of a more broadly based pick-up in inflation, part of which may be persistent and will bear close monitoring.”

Unanimous ‘on hold’ decision

The RBA’s monetary policy board was unanimous in its decision, according to its post-meeting statement.

Breaking: RBA keeps cash rate on hold at 3.6% in December

The Reserve Bank has kept the cash rate on hold at 3.6% at its final meeting of 2025.

Live coverage on ABC News Channel

My colleagues Alicia Barry and David Taylor are bringing you live coverage on the RBA decision — you can watch ABC News Channel at the top of this blog!

Market fully pricing in a cash rate hike by August 2026

Looking at market pricing according to Bloomberg, there is a 50% chance of an 0.25 percentage point interest rate hike by May.

But by August, the market considers a rate hike a certainty.

Let’s see how that shifts in just over 10 minutes time, when we get the RBA decision and statement.

Markets ahead of RBA decision

Local markets are still tracking lower ahead of the Reserve Bank’s interest rate decision (at 2:30pm AEDT).

The ASX200 is down -0.2% to 8,604 points, while the All Ordinaries index is down -0.2% to 8,892 points (as at 2:04pm AEDT).

The Aussie dollar is flat at 66.25 US cents.

It’s widely expected that rates will stay on hold today, so markets have probably priced that in.

Any chance of a rate hike today?

Will the RBA raise rates today? Inflation is out of the target band and rising. Will they gamble this temporary, having learnt a really hard lesson in 2021-22.

– Andrew

One should never say never, unless one had been sitting in on the RBA monetary policy board meeting that would’ve wrapped up a short while ago.

But the market puts a 0% probability on anything other than the cash rate staying on hold today.

There are a couple of very good reasons.

While October’s annual CPI came in very high at 3.8%, there are a lot of base effects driving that number, particularly around electricity prices.

The monthly CPI is also a new dataset, so the RBA will want to see the next quarterly figures released in late January for confirmation around inflation trends before moving.

There is also two sets of jobs data due out before that February meeting, which should influence the RBA’s thinking on the economy.

Aside from uncertainty about just how strong the economy really is and how sharp price pressures are, there’s also considerations around market expectations, as well as consumer and business reaction to a rate move.

The Reserve Bank is not generally in the habit of shocking markets — it causes unnecessarily volatility and erodes confidence.

The same goes for consumers and businesses. Especially right before Christmas, the RBA is highly unlikely to spring a surprise rate hike, which could absolutely destroy the key summer holiday trading period for many businesses.

Much more likely is clear messaging that interest rate hikes are on the table next year, perhaps as early as February.

Although I would be surprised if the RBA also takes the potential for further interest rate cuts off the table just yet.

T-minus 40 minutes until the RBA’s interest rates decision

Thanks for joining us this afternoon … if you’re looking for coverage of the latest interest rates decision, you’re in the right place!

We’ll have the ins and outs of the post-meeting statement, coverage of Michelle Bullock’s press conference, market reaction and analysis, so stick with us.

Loading

US markets and AI predictions

Is the US technology sector in a bubble?

That’s a question business correspondent David Taylor asked co-founder of tech driven equities fund Minotaur Capital, Armina Rosenberg on The Business last night.

Ms Rosenberg expects there to be a 10-15 per cent AI-fuelled market correction next year.

You can watch the full interview below:

Loading…

Renters need double the super of homeowners

New research has found that older Australians who rent will need twice as much superannuation compared to home owners.

That’s according to Super Consumers Australia, who found a typical single retiree paying rent needs $659,000 in super, compared to $322,000 for a home owner.

As for a couple renting, they would need a combined $786,000 in super, compared to $432,000 if they are mortgage free.

You can read the full report from my colleague Jason Dasey below:

Diversa says it will ‘vigorously defend’ ASIC court action on First Guardian

Diversa has responded to the corporate watchdog’s allegations that it failed to show diligence when it hosted First Guardian products on its platforms, and says it will be “vigorously defending ASIC’s claim”.

Diversa noted that the proceedings relate to Diversa’s role as the trustee of the Praemium SMA Superannuation Fund (Praemium) and the YourChoice Super division of OneSuper, which includes Australian Practical Superannuation (AusPrac) and YourChoice Super (YourChoice).

“Diversa notes that in addition to the actions in respect of Falcon Capital (the responsible entity of First Guardian), ASIC has commenced proceedings against Interprac Financial Planning Pty Ltd and entities associated with the Venture Egg financial planning business who (along with others) advised a number of individuals to invest in First Guardian,” the statement said.

“As part of Diversa’s response to the claim, Diversa will be giving consideration to the role that these and other parties may have played in causing loss or damage to members in connection with the First Guardian collapse.”

Diversa acknowledged that members who invested in First Guardian “may be experiencing stress, anxiety and feelings of uncertainty in response to the significant financial losses” and that the super trustee was “committed to continuing to support members through this process” by offering free counselling.

RBA rate hold expectation is a ‘double edged sword’, according to Domain

Domain’s Chief of Research and Economics Dr. Nicola Powell is one of the many economists who believe interest rates will remain the same at today’s RBA meeting.

“A hold today is already baked in. The RBA is still battling persistent inflation, and with rents, energy and insurance costs remaining high, plus stronger-than-expected household spending, there’s simply no room for a fourth cut this year.”

What is more interesting, Dr Powell says, is how expectations have shifted.

“Financial markets see the next move as an increase, rather than a decrease, with a 25 basis-point hike largely priced in before the end of 2026.

She says this is a double edged sword for the housing market.

“This stability cuts both ways. It gives buyers and sellers more certainty around borrowing costs and may help to take some heat out of the rapid price growth we’ve been seeing, especially at the more affordable end.

“However, it doesn’t solve the deeper affordability issues. Mortgage holders are still managing repayments that are significantly higher than they were before the tightening cycle began in 2022.

“But as we’ve seen before, it could take just one weak data point to shift expectations all over again,” she says.

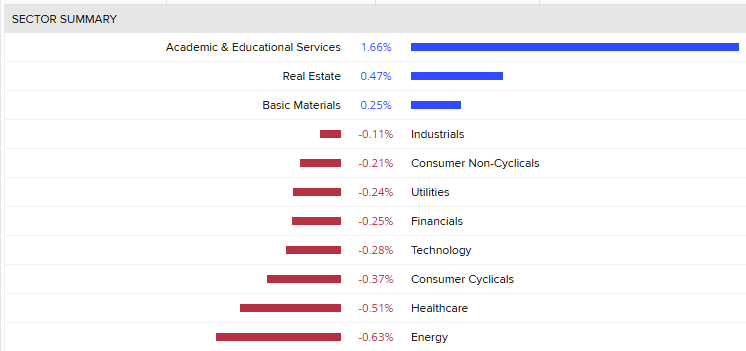

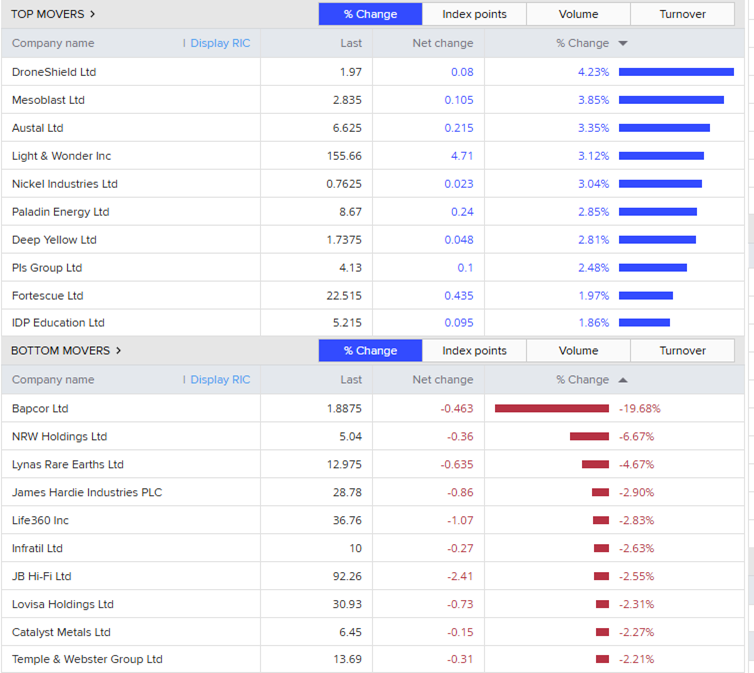

How are local share markets going today?

Hi there,

As expected the ASX200 is trading lower today, after Wall St closed in negative territory.

The ASX is down -0.2% to 8,604 points, while the broader All Ordinaries index is down -0.2% to 8,893 points (as at 12.40pm AEDT).

Energy and healthcare sectors are trading lower, while real estate and educational services are up.

In terms of individual stocks, automotive parts retailer Bapcor is leading the losses today – down almost 20% on downgraded earnings forecasts.

DroneShield and Mesoblast are leading the top performers.

The Reserve Bank decision is coming up at 2.30pm AEDT, where most economists expect rates to stay on hold.

The Aussie dollar is flat at 66.25 US cents.

Samsung fronts Triple Zero outage inquiry

The head of mobile division for Samsung Australia, Eric Chou, is fronting the Senate inquiry into Triple Zero outages.

He notes that the Wentworth Falls incident — a second death that has been linked to a customer’s inability to call Triple Zero on a Samsung mobile phone — is separate to the Optus outage.

These separate issues stem from the national 3G shutdown, back in October last year, which has exposed a flaw in older devices.

Certain older phones still fall back to 3G for Triple Zero calls even though they use 4G for normal calls, meaning they fail completely once 3G networks are turned off.

When Telstra informed us on September 25th of 2025 that a Samsung handset was unable to connect to triple Zero on the Vodafone network, we immediately investigated the issue and discovered that there were 71 older handset models (which) we previously believe were blocked, or requiring software update during the 3G network shutdown, were still active.

71 models translates to thousands of phones around the country.

You can watch the hearing live here or follow the remaining of the hearing over at the ABC’s politics blog.

Market snapshot

- ASX 200: -0.1% to 8,613 points

- Australian dollar: flat at 66.22 US cents

- Wall Street: S&P500 -0.4%, Dow -0.5%, Nasdaq -0.1%

- Europe: Dax +0.1%, FTSE -0.2%, Eurostoxx -0.1%

- Spot gold: +0.1% to $US4,194/ounce

- Brent crude: -0.1% to $US 62.44/barrel

- Iron ore: -1.4% to $US101.90/tonne

- Bitcoin: -0.9% at $US90,510

Prices current around 12:20pm AEDT

Live updates on the major ASX indices: