Rachel Reeves remains under pressure despite being a handed a small bonus after data showed inflation remained unchanged in September. Inflation had been forecast to rise as high as 4 per cent by economic experts, but remained at 3.8 per cent.

Fuel prices have contributed to keeping inflation high, but good news for consumers came with food prices falling for the first time since May last year.

There will still be significant pressure on the government as it prepares to deliver its budget next month, as inflation remains far above the Bank of England’s 2 per cent target.

The Bank has needed to maintain high interest rates in a bid to combat inflation, which has contributed to higher borrowing costs for public finances – which figures yesterday showed have grown by nearly £100bn this year.

A government-set target of 2 per cent inflation is not expected to be seen until at least the latter part of 2026, though many experts have suggested higher inflation and global political instability – along with uncertainty over the UK Budget next month – means that interest rates might not be cut more than once more before the middle of next year.

Follow The Independent’s live coverage of the latest financial, stock markets and business news here:

Finance expert reveals the banks set to lower your savings rates

More on interest rates for your money now.

Personal finance expert Kate Steere, from comparison site Finder, explained which banks or building societies are set to cut interest rates on their accounts soon.

“Inflation is lower than many expected, but it’s still an extremely worrying figure for Brits who are seeing their hard-earned savings eroded in real terms. The impact of this could be softened if providers were committed to offering inflation-beating rates,” she said.

“But, instead, several well-known banks are continuing a campaign of cutting rates despite the base rate staying put. HSBC and Coventry Building Society lowered rates on several savings products on Monday, while Co-op Bank, Barclays and Virgin Money will also reduce select savings rates in the coming days and weeks.

“It’s clear that in the current climate, loyalty doesn’t pay; finding the best deal does. So, make sure you’re seeking out the best inflation-beating rates on the market, even if that means switching providers or exploring digital-only options. Digital banks like Zopa, offering 4.75%, and Chase, with its 4.5% boosted saver, are good examples of where to look.”

Karl Matchett22 October 2025 10:40

Mortgages won’t come down further even if interest rates do – expert

From savings to mortgages – the flip side of the coin as far as interest rates go in households.

Mortgage rates have come down a fair bit this year – but if you’re considering or soon to need a new product, experts have been saying for a while that now’s the time to do it.

Don’t expect any further dramatic lowering of rates as they are already priced in – even if the Bank of England lowers its base rate, says one industry expert.

“The economy is far from out of the inflationary woods, and no-one should expect interest rates to fall any time soon,” said Peter Stimson, director of mortgages at MPowered.

“The mortgage swaps market, which tracks interest rate expectations and is used by mortgage lenders to determine the fixed interest rates they offer to borrowers, still suggests the next base rate cut is most likely to come in the New Year rather than November.

“The market expects a total of two base rate cuts in 2026, but these have already been priced into the interest rates offered by lenders. This means that even when further base rate cuts do come, they’re not likely to make much of a dent in the mortgage interest rates offered to borrowers.

“For now, no change to the inflation number will almost certainly mean no change to mortgage interest rates. After creeping down for much of 2025, for now mortgage rates have probably fallen as far as they can.”

Karl Matchett22 October 2025 10:20

Inflation holding high means savers MUST seek best accounts for their cash

High inflation erodes the spending power of your money over time – it will weaken your financial resilience, whether you have £100 or £100k in the bank.

The way to prevent that is to ensure your money is working hard – by either investing or saving and earning a return higher than inflation.

To cut to the chase, that means any cash savings you hold need to be earning at least 4 per cent to be on the safe side right now – and that’s very much possible if you shop around quickly.

Yesterday, Zopa brought out a 4.75 per cent easy access account for example.

Chip offer 4.32 per cent or higher if you will only make a couple of withdrawals a year. Chase is 4.5 per cent, Cahoot is 4.4 per cent, even the Post Office is 4.1 per cent!

It’s not tough to find these so make sure you don’t leave your money earning one or two per cent just because that’s “who you’ve always banked with”.

Most of these can be opened online and in short time, but choose the one which matches your needs, not just the headline rate – you might get a bonus period, need to put a certain amount in, hold a current account or similar to get each one.

Karl Matchett22 October 2025 10:00

December rates cut possible after ‘rare good news’ for Reeves

Thomas Pugh, chief economist at tax firm RSM UK says the good news of no inflation increase could be a double boost to Rachel Reeves.

While no new cost increases is a relief rather than a victory, if it spurs the BoE to another interest rate cut before year’s end it will be seen as steps in the right direction.

“The surprising stability of inflation staying at 3.8% in September, rather than jumping to 4% as widely expected, marks a rare bit of good news for the Chancellor ahead of a tough budget,” Mr Pugh said.

“Admittedly, inflation will probably trend down only gradually from here, so we doubt this will be enough to tempt the Bank of England into cutting interest rates next month. But it does put a December rate cut back on the cards, especially as the chancellor appears to have learnt from last year’s budget and is determined to avoid another budget-induced inflation jump in April. That means inflation should drop back to below 3% from the spring onwards.

“We still have February as the next opportunity for the Bank of England to cut interest rates, but we think the combination of easing food price inflation, a drop in oil prices and a potentially much less inflationary budget than we had thought might be coming puts a December rate cut back on the cards. This will be a rare bit of positive news for the chancellor, coming so quickly on the back of her recent comments about wanting to see interest rates come down further.”

Karl Matchett22 October 2025 09:41

High inflation a ‘uniquely British disease’ compared to G7

The UK is the outlier among G7 nations and businesses are still feeling the pinch, says the British Chambers of Commerce (BCC).

David Bharier, BCC head of research, said: “Sticky inflation has been in danger of becoming a uniquely British disease as the UK continues to stand out from the rest of the G7.

“Today’s CPI rate of 3.8%, coming in lower than expected, could provide some reassurance that we are at the peak, as expected by the BCC and Bank of England. However, the picture is mixed. Core inflation has slowed, but the reintroduced producer price data show factory gate prices rising at 3.4%, hinting that cost pressures remain in the pipeline, particularly for food and manufacturing.”

The organisation pushed for energy bills to come down and said the upcoming Budget is “pivotal”.

Karl Matchett22 October 2025 09:20

What contributes to inflation in the UK?

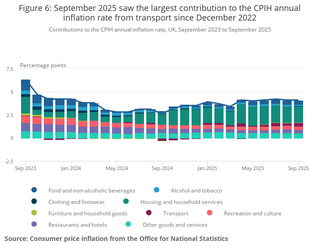

The below chart is useful to scan across the past couple of years and see how different areas have affected inflation in the UK.

On the far left, for example, the purple and pink sections show ‘restaurants and hotels’ and ‘recreation and culture’ contributing far more to inflation than they are now, on the far right side of the graph.

But dark green – ‘housing and household services’ – has been a big inflationary contributor for much of the past year and longer.

Karl Matchett22 October 2025 08:45

Stealth inheritance tax rises lead to record £4.4bn take for Treasury

The amount raised between April and September this year is up 2.3 per cent and is due to be a record for the government.

The boost to the Treasury coffers is in part due to frozen thresholds which have remained in place for years, meaning more and more people are being dragged into the bracket where tax is required to be paid.

Karl Matchett22 October 2025 08:30

Watch out for ‘lifestyle creep’ to help build financial security, says expert

How do families and individuals combat the ongoing high cost pressures?

Alice Haine, personal finance expert at BestInvest urges caution in spending at a time of uncertainty.

There could yet be changes to rules around income tax and frozen thresholds – making sure you’re not seeing money head out unnecessarily is a big part of tightening the reigns.

“One of best ways to ward off the effects of high inflation is to keep spending in check. Lifestyle creep occurs when people loosen their budget as their salary increases and spend on goods and services that they once considered luxuries,” she explains.

“To avoid frittering away money unnecessarily, keep your budget the same when a salary rise comes in and use any surplus income to build up financial reserves, ensuring that money is saved and invested tax-efficiently to reduce the overall tax burden.

“For those without the luxury of an inflation-beating pay rise, reining in spending is always wise in uncertain times. Cancelling unused subscriptions, slashing non-essential spending, particularly on big-ticket items, shifting expensive debts to a 0% balance transfer credit card and building up emergency savings to cover at least three to six months of essential expenses can all help to build up financial resilience.”

Karl Matchett22 October 2025 08:20

Where fears over higher inflation staying within economy stem from

Here’s an explanation on why the fear is that inflation “becomes entrenched” – a phrase you’ll probably hear more than once today.

Because September inflation figures are used to prop up costs later on, like the aforementioned benefits, it means we already know there’ll be an inflationary reaction to account for towards next Spring.

And that leads to concerns we keep going in a circle where higher inflation continues to appear – or being “entrenched” in our economy.

Suren Thiru, economics cirector of the Institute of Chartered Accountants for England and Wales (ICAEW), said:

“While these figures do little to suggest an easing of the financial squeeze on households and businesses, this unexpectedly restrained reading suggests that inflation has now peaked as lower food costs helped keep the headline rate unchanged.

“September’s outturn is likely to have been followed by a slight slowdown this month with the downward pressure from a smaller rise in October energy bills, compared to a year ago, likely to pull headline inflation moderately lower.

“Though it’s probable that inflation has peaked, there is a real risk that these still high price pressures become more entrenched as September’s figures are used to uprate numerous key costs, including benefit payments and firms’ business rate bills.

“Despite softer than expected inflation, the chances of a November rate cut are hanging by a thread, particularly as rate-setters will likely want to analyse the inflationary impact of any measures announced in the Budget before relaxing policy again.”

Karl Matchett22 October 2025 08:14

Will Bank of England lower interest rates?

With inflation steady and no longer rising, the question turns to interest rates and whether the Bank of England’s MPC might now vote to lower rates, particularly around the Budget.

But that shouldn’t be on the agenda, says George Brown, senior economist at Schroders.

Indeed, he feels the markets still predicting interest rate cuts could be completely wrong – and that the BoE could instead go the other direction.

“Inflation near 4 per cent should serve as a wake-up call for markets, which continue to price in two more rate cuts next year. High inflation is at risk of becoming entrenched in the UK, due to a combination of disappointing productivity and sticky wage growth. We expect the Bank of England will keep interest rates on hold until the end of 2026 and we wouldn’t rule out its next rate move being upward.

“Public borrowing figures suggest the Exchequer is experiencing the fiscal downside of this higher inflation – through increased government spending – without being equally compensated by higher revenues. Rather than simply restoring the £10 billion of fiscal headroom through a net tightening of around £25 billion, the Chancellor should consider going further. Building a bigger buffer would reduce the risk of needing to further course correct if growth and spending diverges again from the OBR’s forecast.”

Nick Saunders, CEO of Webull UK, suggested the markets might be shaken by political discourse.

“Just avoiding the psychological barrier of 4% is a release of pressure for the Chancellor. Not good news, but an escape. Looking across the channel prices in France are rising significantly slower with inflation at 1.1%, undermining claims that this is purely a global phenomenon. With the narrative of worldwide inflationary pressures losing credibility, concerns about backsliding are likely to unnerve investors, which is really is not good news for the markets.”

Karl Matchett22 October 2025 08:10