TIACA’s Glyn Hughes outlines how air cargo must adapt to e-commerce’s rapid growth through harmonised standards, smarter data, and sustainable operations.

At the close of 2024, e-commerce accounted for approximately 20% of air cargo volumes worldwide, with projections that those volumes could double within the following decade.

Various business models have been employed to handle, process, transport, clear and deliver this high volume of shipments. However, as the growth happened over a rapid period, accelerated by COVID-induced changes in consumer behaviours, many deviations to processes emerged.

E-commerce shipments are not governed by industry standards in terms of processing or handling and there are no international regulations that cover handling for this specific commodity, although e-commerce shipments must comply with safety and security regulations.

In addition to a lack of industry standards, deviations in government regulations, deviations in standard operating procedures and deviations in customer expectations all contributed to a complex and challenging business environment.

E-commerce market outlook

Air cargo accounts for approximately 35% of global trade value annually, worth an estimated USD 9.0 trillion dollars. In volume terms, this equates to more than 64 million metric tonnes.

E-commerce volumes have grown steadily over the last five years, and industry estimates indicate that it now accounts for over 12 million metric tonnes.

Changes in consumer behaviour have shifted from traditional retail ‘brick and mortar’ to online marketplaces, C2C platforms and direct sales channels. Social media-based retail activity, via Instagram, Facebook and the growing TikTok shop amongst others are accelerating this evolution as retail is now available 24 hours a day and accessible via smart phone technology. Global payment systems support this ‘shop anywhere anytime’ mindset.

Ex-China e-commerce reached 4.4m tonnes in 2024 and has grown 38% p.a. since 2021. China e-commerce volumes have almost doubled in the past two years.

Low-value e-commerce reached 55% of China-US air trade volumes in 2024 at the expense of general air cargo.

More recently, with the US tariff changes since the beginning of April 2025 and the removal of the ‘de minimis’ exemption since the start of May, a strong impact is observed on the e-commerce origins China/HK to the US.

E-commerce safety across the supply chain

Safety and security remain the air cargo industry’s top priority, so it bears noting that the rapid growth of e-commerce has brought additional safety and security concerns, particularly with the low barrier to entry for global shippers and the proliferation of C2C and B2C environments.

The rapid growth of e-commerce, projected to reach $8 trillion in global sales by 2027, has reshaped air cargo safety in three key ways:

- Surge in Shipment Volume & Complexity, with small, high-frequency shipments complicating screening, labelling and compliance enforcement

- Hazardous Materials Risks – Lithium battery shipments, growing 30% annually, account for a significant portion of air cargo fire risks. In recent years, more than 50% of reported air cargo fire incidents involved lithium battery-related shipments

- Security & Cyber Threats – Smugglers exploit fragmented e-commerce logistics to ship counterfeit or illegal goods, while cyberattacks on air cargo tracking systems have risen by 15% annually, increasing risks of shipment fraud and data breaches.

Simplified and aligned processes

Air cargo is complex by nature as cargo is moved on behalf of millions of shippers across 193 countries, involving more than 20,000 connected points on the services of over 700 airlines with thousands of truckers, freight forwarders and ground handlers getting involved.

The compliance environment involves international and national regulations, trading bloc conditions and operator-specific instructions. For the industry to operate efficiently, we seek simplified and aligned processes wherever possible.

The rise of e-commerce has transformed air cargo operations, necessitating significant changes in data management practices. Traditionally, air cargo relied on fragmented data systems that varied by carriers, freight forwarders and customs agencies.

The surge in e-commerce has heightened the need for real-time tracking, efficient customs clearance and optimised last-mile delivery. Key changes include the adoption of standardised data formats (e.g., IATA Cargo-XML or ONE record), the integration of advanced technologies like blockchain for data transparency and the implementation of automated data exchange protocols. These changes promote interoperability and enhance data accuracy, enabling stakeholders to respond swiftly to market demands.

Sustainability

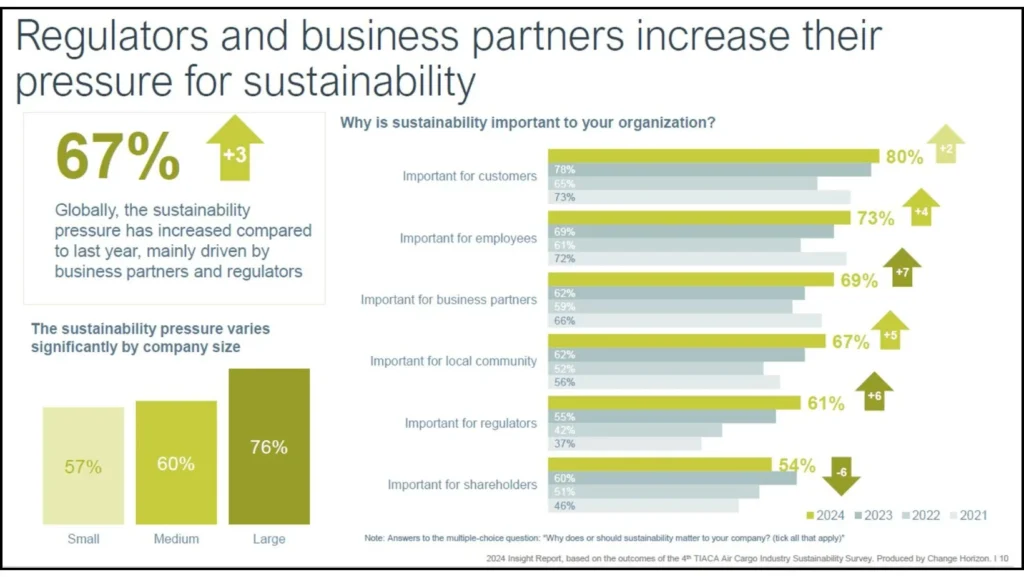

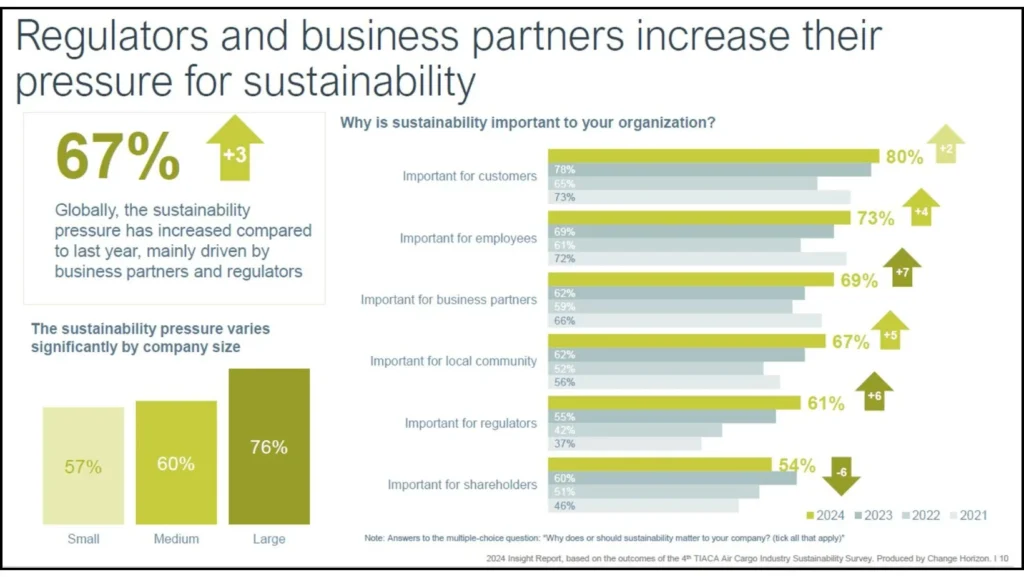

Sustainability considerations are becoming increasingly critical for air cargo and, consequentially, e-commerce logistics. The TIACA annual Sustainability survey illustrates that sustainability considerations are important for many industry stakeholders, as illustrated in the chart below.

This article continues after the below picture…

As e-commerce continues to grow, its impact on air cargo operations has raised concerns about sustainability, particularly in terms of environmental impact and waste management.

The rapid rise in parcel volumes has led to increased air freight traffic, contributing to higher carbon emissions and energy consumption. The environmental challenges are compounded by the growing demand for expedited deliveries, often requiring higher frequency and shorter lead times.

To address these challenges, air cargo companies are focusing on reducing their carbon footprints through various measures. The shift toward more fuel-efficient aircraft, investment in sustainable aviation fuels (SAF) and the use of electric ground support equipment (GSE) are key changes aimed at minimising emissions.

Additionally, air cargo providers are working on waste reduction strategies, such as optimising packaging, reducing single-use plastics and recycling materials.

Technology plays a significant role in improving sustainability by enabling better route optimisation and energy management systems. Advanced data analytics and AI are being used to forecast demand, optimise flight schedules, and minimise excess fuel consumption.

Furthermore, the integration of sustainable practices in last-mile delivery through electric vehicles, drones and optimised packaging further enhances the sustainability of e-commerce logistics.

These changes are crucial in balancing the increased demand for air cargo with the growing need to reduce environmental and waste management impacts.

Summary

The e-commerce sector will continue to evolve as consumer behaviour, business operations and regulatory environments change. Air cargo will remain ideally placed to capitalise on these evolutions from lower value B2C and C2C as well as growing values in the B2B sectors. Although more stringent formal customs entries can be anticipated.

Safety is a critical concern, especially with lithium battery risks and increased cyber threats. We must strive for stricter compliance, enhanced screening, and global regulatory harmonisation. Customs management must address fraud and processing delays, calling for digitalisation, AI-driven risk analysis, and global standards.

Process simplification is essential for improving efficiency, with technology investment and inter-stakeholder collaboration identified as key enablers. The need for common data infrastructure based on industry standard communication and data protocols architected for next level use in data analytics, AI agents and large language models (LLMs) is crucial.

Infrastructure challenges remain a critical growth factor as demand for investment often exceeds that which is available within supply chain partners. It is expected that private capital investment targeting real estate development will need to be leveraged to ensure new facilities are available to address the growing demand.

Ground handlers are burdened by fragmented standards and rising parcel volumes, requiring training and digital upgrades. Freight forwarders must adjust to smaller shipments and customer-centric models while ensuring compliance and technological integration. Final-mile delivery is a vital link, benefiting from automation, localised hubs, and drone use to meet customer expectations.

Reverse logistics is becoming increasingly critical due to high return rates in e-commerce, necessitating streamlined systems and green logistics. Innovation, particularly through AI and drones, will reshape efficiency, cost-effectiveness, and sustainability. Sustainability concerns cut across all operations, prompting calls for carbon reduction, waste minimisation, and green technology adoption.

Conclusion

E-commerce is not just a new cargo segment but a paradigm shift in air logistics, demanding coordinated industry-wide innovation, regulatory reform, and sustainability focus. By adopting standardised practices, investing in digital infrastructure, and strengthening global cooperation, the air cargo industry can align with the future demands of e-commerce while ensuring safe, efficient, and environmentally responsible operations.

Airports have a pivotal role to play as the air cargo industry moves ahead with managing increased e-commerce volumes. Airport communities and common systems facilitate the various supply chain partners exchanging data, aligning on practices and preparing for this new era of industry expansion.

TIACA will continue to support the industry through this business evolution and new focus on sustainable solutions with tools, education, knowledge, advocacy and outreach.