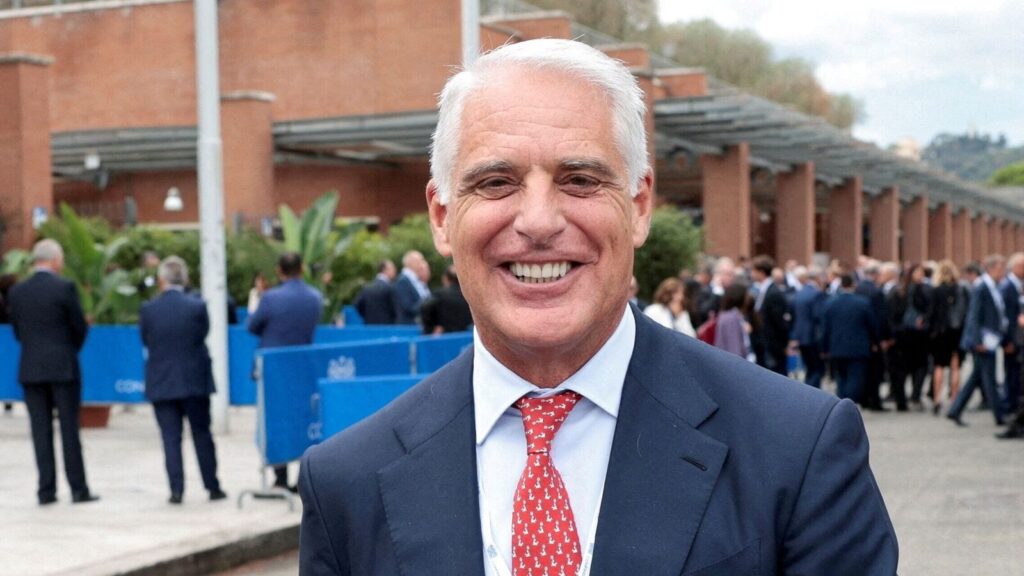

The career of Andrea Orcel vividly encapsulates the recent history of European banking. At Merrill Lynch, now part of Bank of America, Mr Orcel advised on deals that formed part of the wave of mergers that crested in 2007, when a pan-European troika bought ABN AMRO, a Dutch lender. After the financial crisis of 2007-09, grand cross-border ambitions were ditched. Mr Orcel’s next job was to run the investment-banking arm of UBS, a Swiss champion.

After an abortive move to Santander, a Spanish bank, Mr Orcel landed on his loafers in the top job at UniCredit in 2021, shortly before interest-rate rises bounced the sector back to profitability. He is justifiably credited with the Italian lender’s resurgence; its share price has quadrupled since he was appointed. Now his designs on Commerzbank, a German lender, are testing the EU’s appetite for the integrated financial system its leaders say it needs.

On September 11th UniCredit said it had bought a 4.5% stake in Commerzbank from the German government, adding to its pre-existing position of the same size. Speaking to your columnist in Prague, where Mr Orcel had travelled to address colleagues in the grounds of the Strahov Monastery, the banker says he was surprised by the explosive political reaction that followed his bank’s investment.

“We bought that stake transparently, with respect to our position and our intentions, in a process that was also transparent. We had every reason to assume that this was a welcome investment.” Since then UniCredit, through derivatives trades, has increased its position in the bank to just above 21%.

Olaf Scholz, Germany’s chancellor, has fulminated against “unfriendly attacks” on the country’s lenders. One member of Commerzbank’s board says he is nauseated by the prospect of Mr Orcel cutting costs at the bank.

UniCredit’s German expedition is less surprising to analysts, who have long predicted consolidation in the country’s banking industry. Bosses of both firms have, in the past, talked about combining Commerzbank with HypoVereinsbank, the German lender UniCredit bought in 2005, according to Mr Orcel. They are “almost a perfect match” for each other, he says, noting the lack of overlap in states such as Bavaria. Mr Orcel reckons a combined bank would have a 10% share servicing corporate clients, reaching perhaps the low teens in the Mittelstand, Germany’s dense fabric of small firms. All to the good, he says: Europe’s economic competitiveness remains blunted by the lack of strong, pan-European lenders.

It is a compelling pitch, and one Mr Orcel makes energetically. But if UniCredit’s investment in Commerzbank becomes a takeover bid, investors are likely to pay less attention to potential revenue “synergies” than to reductions in the combined bank’s costs. Should that involve firing many workers, expect politicians to shelve their calls for ambitious continental renewal. Few doubt that Commerzbank could be run more profitably. During the most recent quarter, UniCredit’s cost-to-income ratio in Germany was 20 percentage points lower than that of Commerzbank as a whole. That’s a cavernous gap—even considering Commerzbank’s larger retail business. Mr Orcel says management staff at the corporate centre would bear the brunt of the cuts, implying few branch closures.

Mr Orcel says he has not hired investment bankers to prepare for a deal. If he does, how might Commerzbank prepare its defence? It would be unwise for it to rely on the European Central Bank limiting UniCredit’s shareholding, or the German government using its remaining 12% stake to hinder a deal. And there are few signs of a white knight galloping up the autobahn to give it more cover. Last week Bettina Orlopp, Commerzbank’s new boss, raised the bank’s profit guidance and pledged more shareholder pay-outs. But investors are cagey. The bank has a history of making rosy forecasts which it then misses.

If Mr Orcel ends up creating a European champion, he will then have to run it. The lack of a complete banking union would be a headache. So might politics around a merged entity in Germany. Is there a scenario where UniBank becomes CommerzCredit? Mr Orcel rejects the idea of moving a combined bank’s headquarters to Germany. The bank is “very, very proud” of its Italian roots, he says; moving north would be yielding to political pressure. Besides, Italians seem no more willing to give up their banking stars than their German friends.

© 2024, The Economist Newspaper Ltd. All rights reserved.

From The Economist, published under licence. The original content can be found on www.economist.com